This post was most recently updated on April 4th, 2024

Ad Exchange, or AdX, has emerged as a popular method for publishers to sell their ad space to advertisers in real-time auctions. It has sped up the way online advertising works, and in this article, we will explore the workings of ad exchanges and how they benefit publishers.

|

Do you know how to navigate the complex world of Ad Exchanges? At MonetizeMore we have established relationships with all the Tier 1 and Tier 2 advertising exchanges. Want help to get access to their demand? Sign up to MonetizeMore today! |

You might be thinking, what is an Ad Exchange? Well, it is a technology-driven platform where publishers can sell their ad inventory, and advertisers can buy it. This advertising inventory can include video, mobile, display, in-app and other types.

Through Advertising Exchanges, multiple ad networks come together on one platform. Real-time bidding (RTB) technology is used to buy/sell inventory and determine prices on an impression basis. An Ad Exchange can also be commonly referred to as a Supply-Side Platform or SSP.

For publishers, this is beneficial since they can sell their inventory and potentially get more bang for their buck from a consolidated source containing a large pool of advertiser demand. For buyers/advertisers, it gets easier to reach a mass audience, use advanced targeting technology to increase campaign effectiveness and zero-in on their preferred audience.

This video below breakdown what you can do after setting up AdX:

At its core, an ad exchange is a technology platform that facilitates the buying and selling of digital ad inventory. Publishers offer their available ad spaces for sale on the exchange, and advertisers can bid on them in real-time, using automated processes and algorithms. The highest bidder wins the ad space, and their ad is displayed on the publisher’s website for a set period of time.

Ad exchanges have revolutionized the way digital advertising works. Before ad exchanges, advertisers and publishers had to negotiate deals with each other directly, which was time-consuming and often inefficient. Ad exchanges have made the process much smoother and more streamlined, allowing advertisers to reach their target audience more effectively and publishers to earn more revenue.

One of the key benefits of ad exchanges is their ability to target specific audiences. Advertisers can use data to target their ads to specific demographics, such as age, gender, location, and interests. This means that ads are more likely to be seen by people who are interested in the product or service being advertised, which increases the chances of a successful campaign.

Another benefit of ad exchanges is their ability to offer real-time bidding. This means that advertisers can adjust their bids in real-time based on how well their ads are performing. If an ad is performing well, the advertiser can increase their bid to ensure that it continues to be displayed. If an ad is performing poorly, the advertiser can decrease their bid or stop bidding altogether.

Ad exchanges also offer a level of transparency that was previously unheard of in the advertising industry. Advertisers can see exactly where their ads are being displayed and how they are performing. This allows advertisers to make informed decisions about their campaigns and adjust them as needed.

In conclusion, ad exchanges have transformed the digital advertising industry. They offer a transparent and efficient marketplace for advertisers and publishers to buy and sell ad space, and they allow advertisers to target specific audiences and adjust their bids in real-time. Ad exchanges have made digital advertising more effective and profitable for everyone involved.

A Preferred Deal is a direct agreement between a publisher and an advertiser. It offers publishers control over pricing and the buyers who get access to their premium inventory. For advertisers, it means exclusive access to desirable ad space at a negotiated rate.

Think of it as a VIP pass for advertisers. Publishers offer select buyers priority access to premium inventory at a set price. This guarantees advertisers the ad space they want, while publishers secure reliable revenue. It’s a win-win for both sides!

Ad exchanges have revolutionized the way that online advertising works, making it easier and more efficient for publishers to monetize their websites and content. By offering a transparent and competitive marketplace for buying and selling ad inventory, ad exchanges have increased revenue for publishers and made it easier for businesses to reach their target audiences.

Ad exchanges are used by a wide range of advertisers, from small businesses to large corporations. Advertisers can bid on ad inventory using automated processes and algorithms, which allows them to reach a large audience without having to negotiate directly with publishers. Ad exchanges offer a level playing field for all advertisers, regardless of their size or budget.

Ad exchanges are like a virtual auction house where advertisers and publishers can buy and sell ad space. It uses real-time bidding (RTB) to instantly match ads with available inventory. An SSP is a software platform specifically designed for publishers letting them manage their ad inventory, access multiple ad exchanges and demand sources, and control pricing.

Here’s a table comparing Ad Exchanges and Supply-Side Platforms (SSPs):

| Feature | Ad Exchange | Supply-Side Platform (SSP) |

|---|---|---|

| What is it? | A digital marketplace where advertisers and publishers buy and sell ad inventory via real-time bidding (RTB). | A software platform that helps publishers manage, sell, and optimize their ad inventory across multiple ad exchanges and demand sources. |

| Who uses it? | Both advertisers and publishers | Primarily publishers |

| Level of Control | Offers some control to both buyers and sellers. | Gives publishers a high degree of control over who buys their ad inventory, how it’s priced, and optimization strategies. |

| Features | Focuses on real-time bidding, matching ads with inventory, and facilitating transactions. | Often includes advanced features like yield optimization tools, data management, reporting, and the ability to create private marketplaces. |

| Benefits | Streamlines the ad buying process, increases fill rates, and maximizes exposure. | Maximizes revenue potential, offers granular control, and helps publishers gain insight into their inventory’s value. |

| Best for… | Advertisers and publishers seeking efficiency and a wide range of inventory options. | Publishers with significant ad inventory who want advanced control, optimization tools, and access to multiple demand partners. |

It’s easy to get confused and mix Ad Exchanges up with Demand Side Platforms (DSP). These two programmatic platforms are not the same. Instead, they are meant to complement each other.

Ad Exchanges are platforms part of the programmatic advertising ecosystem which makes ad inventory from multiple ad networks available for purchase by advertisers through RTB technology.

To utilize the Advertising Exchange platform a buyer/advertiser needs something that can manage the bids for them. This bid application or software interacts with the exchange’s RTB API and helps the buyer assess available impressions.

The DSP enables the advertiser to automate the ad buying process within a range of multiple exchanges while all the information such as inventory costs, ad placement, ad sizes and more remain transparent.

Ad exchanges being the publishers’ marketplace where publishers sell their ad space and advertisers buy it are of 3 types mainly:

A publisher can decide to set up a private ad exchange for a few reasons. One fundamental reason is the fact that private means higher quality ad inventory for advertisers and higher prices resulting in better ad revenue for publishers.

Let’s say you operate an auto review site and you put your inventory on a private ad exchange for select automakers. Since the topic is so highly related to the advertiser’s core product line, they can increase their spend on your inventory. It could mean changing a once-off buyer into a long-term customer.

Besides the potential for long-term customers, less time, work and money go into monetizing premium inventory this way.

Publishers also remain in control as they can directly specify who gets access to their ad inventory and with that, the price they want to accept for that inventory.

The publisher might even be able to sell less profitable or even non-premium inventory to buyers. If their non-premium inventory has some relation to their premium selection, the chances remain that the buyer might be interested.

Even though private exchanges poses many benefits, it needs to fit your business model. The possibility remains for buyers to pay higher prices than with the open market, so you’ll need to be able to sell and provide the value as perceived.

Accurate and exceptional ad inventory data is crucial to a publisher succeeding with this setup.

Both these ad tech companies can seem very much the same but have some key characteristics that set them apart.

An ad network combines the ad inventory from many publisher websites into one platform and resells it to advertisers by adding a certain margin to the inventory. They also group inventories according to specific demographic elements such as user age, gender, location and more.

An Advertising Exchange does not conduct arbitrage as their advertising network counterpart. Here, pricing of impressions and websites where ads appear are transparent which is not the case with ad networks.

Ad Exchanges can also give access to more publisher ad inventories than Ad networks since they integrate multiple sources into one platform. DSPs are used here and include better targeting options as compared to Ad Networks for advertisers.

As a publisher, choosing the right ad exchange is essential to maximizing your revenue and ensuring that your website is monetized effectively. While there are many ad exchanges available, some stand out as being particularly good for publishers.

Google Ad Exchange is one of the most popular ad exchanges for publishers, and for good reason. This exchange offers access to a large pool of advertisers, which means that publishers have a greater chance of finding relevant ads that will appeal to their audience. Additionally, Google Ad Exchange has a user-friendly interface that makes it easy for publishers to manage their inventory and track their earnings.

Another benefit of Google Ad Exchange is that it offers a wide range of ad formats, including display, video, and mobile. This means that publishers can choose the format that works best for their website and audience, and can experiment with different formats to see which ones generate the most revenue.

Magnite is another popular ad exchange for publishers. This exchange offers a real-time bidding platform that allows publishers to sell their inventory to the highest bidder. This means that publishers can maximize their revenue by ensuring that they are getting the highest possible price for their ad space.

In addition to its real-time bidding platform, Magnite offers a range of other features that can benefit publishers. These include advanced targeting options, detailed reporting and analytics, and a user-friendly interface that makes it easy to manage your inventory and track your earnings.

Xandr is a popular ad exchange that is known for its advanced targeting capabilities. This exchange uses machine learning algorithms to analyze user data and deliver highly targeted ads to the right audience. This means that publishers can maximize their revenue by delivering ads that are more likely to be clicked on and generate conversions.

It also offers a range of ad formats, including display, video, and native. This means that publishers can choose the format that works best for their website and audience and can experiment with different formats to see which ones generate the most revenue.

OpenX is another popular ad exchange that offers a range of features and benefits for publishers. This exchange offers a real-time bidding platform that allows publishers to sell their inventory to the highest bidder, which means that publishers can maximize their revenue by ensuring that they are getting the highest possible price for their ad space.

In addition to its real-time bidding platform, OpenX offers a range of targeting options, including contextual targeting, behavioral targeting, and geographic targeting. This means that publishers can deliver ads that are more likely to be relevant to their audience, which can lead to higher click-through rates and conversions.

Overall, there are many ad exchanges available for publishers, but the four listed above stand out as being particularly good options. By carefully evaluating your options and choosing the exchange that best fits your needs, you can maximize your revenue and ensure that your website is monetized effectively.

Most publishers know and use AdSense since it’s one of the biggest, if not the largest, ad network in the world that is owned and operated by Google.

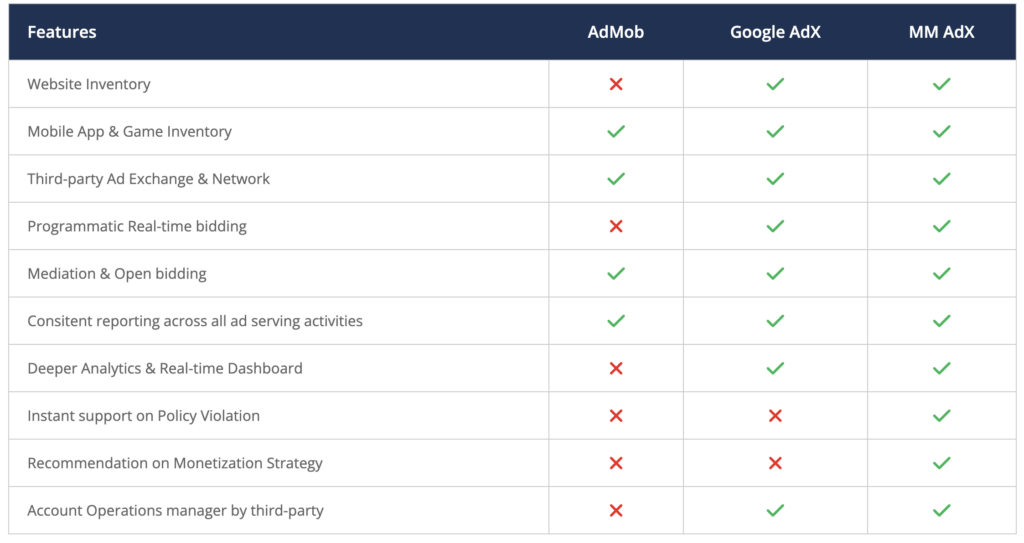

On the other end, Google also offers what it calls its range of Ad Exchange through Google Ad Manager.

AdX is the premium version of AdSense which was built specifically for premium publishers and advertisers.

As a publisher, getting access to this ad exchange means putting your ad inventory in front of all the advertisers found in AdSense as well as additional premium/big brand advertisers. Publishers who switch from AdSense to Google Ad Manager with MonetizeMore tend to see a 25%+ increase in their ad earnings.

For the official Google product comparison chart visit this link.

Besides increased earnings, there are other beneficial factors to consider for a publisher when switching over to AdX such as gaining access to:

However, publishers can only gain access to this network by either being invited by Google or joining through one of Google’s certified partners. MonetizeMore is a certified Google partner and can help you get started via our master Google Ad Exchange for publishers’ account.

Click here to switch from AdSense to DoubleClick Ad Exchange

Choosing the right ad exchange can significantly impact your success as a publisher.

Here are some key tips for choosing the ad exchange that’s the best fit for your needs as a publisher or advertiser:

Here’s a look at what to expect in the world of ad exchanges in the coming year.

Publishers have been relying on ad exchanges for many years. However, there is a growing trend of the market moving over to programmatic direct and private marketplaces.

As a publisher, you can pursue a strategy that uses these direct and PMP offerings alongside your core open ad exchange monetization. Having a balanced and sophisticated ad revenue strategy will bring in higher earnings for your site and give you more control over the process.

Media buyers and advertisers for big brands supplement their open ad exchange bidding with these private marketplace deals and work with publishers directly as they can gain a competitive advantage with the right publisher partnership.

How many publishers can reduce their reliance on ad exchanges remains uncertain. Not all publishers have premium traffic that would attract private deals. The same goes for advertisers who all don’t have access to private marketplaces and might not be able to scale accordingly with such deals. Advertisers will still find quality inventory at fair prices on the open exchange.

We see that programmatic direct and PMP deals will not be enough to move the majority of publishers away from ad exchanges completely.

Sign up for a Starter account at MonetizeMore today!

Steroids And The Cowboys: A New List To Chew On – D Magazine winstrol pills price robust returns: this pharma stock turned rs 1 lakh to rs 1.85 crore in 10 years

The biggest ad exchanges are Google AdX, Magnite, Xandr, OpenX and Smaato

Ad exchanges typically generate revenue by charging both publishers and advertisers a small percentage of each successful ad transaction. Some exchanges add a markup to the price paid by the advertiser, taking the difference as profit while others may charge publishers a monthly or annual fee to access their platform and services.

Google AdX is Google's ad exchange, where publishers and advertisers connect in real-time bidding.

Ad Exchanges are programmatic auction platforms where publishers sell ad inventory, and advertisers buy it. Multiple ad networks connect through one platform, and real-time bidding is used to buy/sell inventory. Participants get access to advanced targeting features to increase their campaign effectiveness.

SSPs get publishers to connect with multiple ad networks and ad exchanges, which increases competition for their ad inventory helping them make more ad revenue by providing access to a larger pool of advertisers and demand sources.

Ad exchanges act as platforms facilitating the trading of ad inventory between advertisers on a DSP (Demand-Side Platform) and publishers on an SSP (Supply-Side Platform), creating a direct marketplace for buying and selling ad space.

SSPs enable publishers to connect with multiple ad networks and ad exchanges, which helps increase competition and maximize revenue by offering access to a broader range of advertisers and demand sources.

Publishers can set controls like accepted ad categories, minimum price for an ad, and the type of ads they want to display on their websites using an SSP for ad revenue optimization.

SSPs help publishers monetize their ad space by putting it up on ad exchanges, allowing them to generate ad revenue by setting controls such as accepted ad categories, minimum ad prices, and the types of ads they want to display.

With over seven years at the forefront of programmatic advertising, Aleesha is a renowned Ad-Tech expert, blending innovative strategies with cutting-edge technology. Her insights have reshaped programmatic advertising, leading to groundbreaking campaigns and 10X ROI increases for publishers and global brands. She believes in setting new standards in dynamic ad targeting and optimization.

Paid to Publishers

Ad Requests Monthly

Happy Publishers

10X your ad revenue with our award-winning solutions.