Dive into the Future: AdTech Predictions for 2024 Tailored for Publishers! As we step into 2024, programmatic advertising is brimming with changes that could redefine how publishers navigate AdTech. From the potential delay in cookie deprecation to the evolving challenges of bot traffic and the shifting trends in global ad spend, this insightful article unpacks what’s next for publishers in the dynamic world of AdTech. Stay ahead of the curve with our expert predictions and strategies designed to empower publishers in the ever-evolving digital advertising ecosystem.

Related read: https://www.monetizemore.com/blog/programmatic-advertising-explained/

In 2024, I foresee Google potentially delaying the deprecation of third-party cookies to 2025, a move with significant implications for the digital advertising world. Advertisers and publishers would likely continue depending on third-party cookies for another year, maintaining their current strategies for targeted advertising and audience segmentation. This delay could slow the industry’s shift towards alternative solutions like contextual targeting and first-party data strategies.

For publishers, this delay might offer short-term financial relief, allowing them to sustain ad revenues through cookie-based programmatic advertising. However, advertisers could face ongoing uncertainty, potentially causing hesitation in fully adopting new advertising models and technologies.

The postponement of cookie deprecation could also attract increased regulatory scrutiny. Privacy advocates and regulators might push harder for more privacy-focused approaches in digital advertising, highlighting the need for companies to balance cookie usage with growing demands for user privacy. The extended reliance on cookies could impact cross-device tracking and attribution models, which currently depend significantly on cookies.

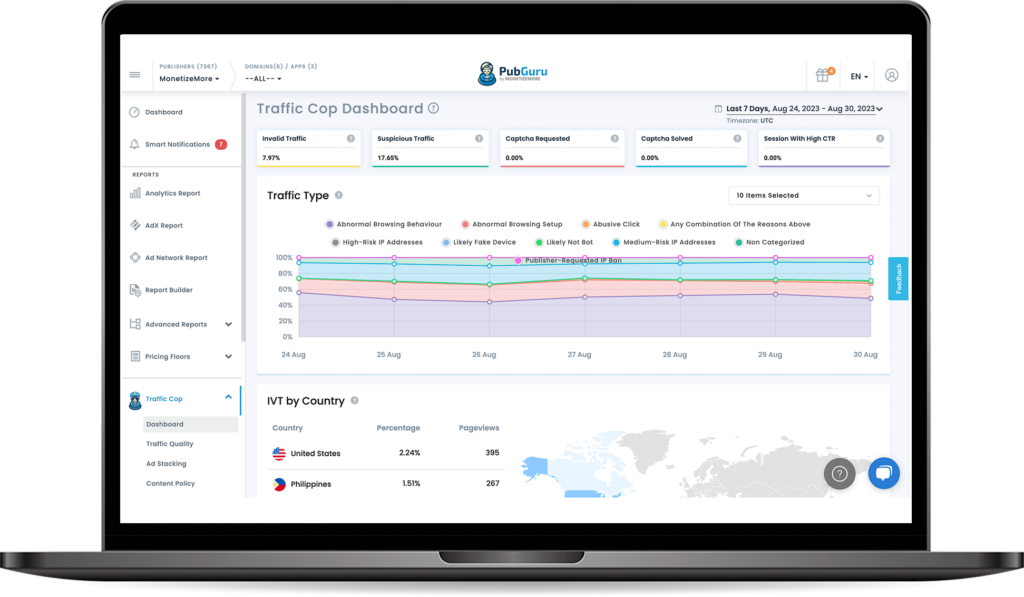

As we move into 2024, I’m worried about the continued rise of bot traffic and other forms of invalid traffic (IVT). This concern has been building up since the last few years. In 2023, we saw a marked increase in the sophistication of bot activities, which made them harder to detect. This trend, combined with fraudulent activities like ad stacking and pixel stuffing, led to a significant rise in IVT. As a result, advertisers have been increasingly worried about the diminishing returns on their investments, with a large portion of their budgets being wasted on non-human traffic.

From my perspective, this surge in IVT poses a real threat to publishers’ reputations and their financial viability. The perception that their digital spaces are compromised by invalid traffic could lead to a loss of trust from advertisers, potentially resulting in a decrease in ad revenue. Similarly, as someone closely monitoring the trends, I see Supply-Side Platforms (SSPs) and Demand-Side Platforms (DSPs) facing their own set of challenges. They need to enhance their technology to better identify and filter out this sophisticated IVT, a task that is both costly and demands ongoing innovation.

In response to these challenges, I foresee a significant focus in 2024 on developing and implementing advanced IVT detection tools. Award-winning tools like Traffic Cop which harness AI and machine learning, will be key in effectively identifying and combating bot traffic. I also anticipate a move towards greater collaboration within the industry. Sharing data and insights to fight IVT collectively could lead to the establishment of industry-wide standards and a boost in transparency.

I predict that in 2024, the global digital ad spend will not meet Group M’s forecast of 7.3% year-over-year growth. This assessment stems from several factors that are influencing the advertising industry. The ongoing challenges with invalid traffic and the uncertainty around cookie deprecation are likely to impact advertiser confidence and spending. Additionally, economic factors, such as fluctuating market conditions and potential global economic slowdowns, could lead to more conservative ad budgets.

Also, there’s an anticipated shift in ad spend priorities, with emerging formats like CTV gaining prominence but potentially disrupting traditional digital ad spend patterns. This complex landscape suggests that while growth is still expected, it might not reach the levels predicted by Group M.

In 2024, the ad tech scene is getting a serious makeover, thanks to the spotlight on made-for-advertising (MFA) sites. These sites, hogging a big chunk of online impressions, are not just guzzling down global ad spend but also upping the carbon waste and muddling supply-chain optimization.

The good news though: in-app and CTV are totally MFA-proof, offering a savvy shift in where the budget’s going. We’re seeing a cool move from exchange spends to more deal spends, like PMPs. Media buyers are getting smart, leaning into platforms offering first-party audience synergies and data that go beyond just behavior tracking. As the cookie crumbles, deals and segmentation are the new power players. 2024? It’s the year we get real about ditching deceptive ads and pushing for sustainable, straight-up ad tech solutions.

One of the most important trends is certainly the increasing use of artificial intelligence (AI) in the data sector. The use of AI can unfold extensive potential to create benefits and increase value, particularly in terms of inventory usage, monetization, and precise and efficient customer contact.

However, AI requires ethical guidelines for its design and the use of its results. Firstly, to ensure that cognitive-behavioral biases are not reflected in data and algorithms and thus reinforce or increase critical undesirable developments in automation, data-driven decision-making, and machine learning. This applies in particular to the protection of users’ privacy and the handling of their data. Secondly, so that sustainability requirements resulting from the resource-intensive nature of the technologies are met. Commercial companies in particular have a responsibility to take appropriate care here to avoid legal and possibly regulatory problems.

The upcoming AdTech era will be characterized by enhanced collaboration between buyers and sellers, focusing on the transparent and ethical exchange of data. This shift marks a significant change in how the industry values and handles consumer privacy and data transparency.

While the ad revenues might dip in the short term, publishers will be able to compensate for these dips via more optimal ad tech implementations and optimizations like server-to-server, video header bidding, and bot blocking. Opportunities to increase RPMs and ad revenues have never been greater for publishers, but a proportional demand for resources would be necessary. As the industry matures, complementary tools and services will be available to make these types of implementations more accessible.

2024 will look even better for you with 10X more ad revenue. Click here to achieve that now.

Kean Graham is the CEO and founder of MonetizeMore & a pioneer in the Adtech Industry. He is the resident expert in Ad Optimization, covering areas like Adsense Optimization,GAM Management, and third-party ad network partnerships. Kean believes in the supremacy of direct publisher deals and holistic optimization as keys to effective and consistent ad revenue increases.

Paid to Publishers

Ad Requests Monthly

Happy Publishers

10X your ad revenue with our award-winning solutions.