Video advertising remains a powerful and influential medium for publishers across the digital spectrum. Leveraging video ads offers both advertisers and publishers a dynamic, engaging, and effective way to connect with their audience. In this guide, we will delve deeply into the facets of video advertising, helping publishers understand and make the most of this potent tool.

With the rise of AI and the dynamic world of industry standards, Google has streamlined its Video Publisher policies to make it more efficient and clear for everyone. This applies to all video inventory monetized by Ad Manager, AdMob, and AdSense publishers.

It is important to pass the two signals for programmatic video buyers: vpmute field for GAM publishers and the plcmt field supporting this year’s IAB OpenRTB video update.

The IAB OpenRTB video updates mentioned are the 4 values attributed in Object:Video for plcmt. These are: value 1 is instream (Pre-roll, mid-roll, and post-roll ads); 2 is Accompanying Content (Pre-roll, mid-roll, and post-roll ads); 3 for interstitials; and 4 for No Content/Standalone.

These video guidelines should serve as a clear guide to maximizing all publishers’ inventory. This also emphasizes transparency in the marketplace and inventory appreciation.

The landscape of video advertising is ever-evolving, with platforms continuously innovating to capture audience attention. In 2024, the dominance of certain platforms has been shaped by both technological advancements and changing user behaviors.

While Facebook/Meta has been a longstanding leader in social media, its emphasis on video content has only deepened over the years. Facebook’s video ad platform has grown to include more immersive experiences, integrating AR and VR components to engage audiences better. The platform’s algorithmic emphasis on video content ensures that advertisers get prime visibility and engagement.

Snapchat has continually evolved, moving beyond ephemeral content to offer a range of video experiences. With the introduction of longer-format video content and interactive ad formats, Snapchat provides advertisers with innovative ways to engage, particularly with the Gen Z demographic.

YouTube remains the titan of video content online. It has diversified its ad offerings, allowing for more interactive ad experiences. The rise of YouTube Shorts, its short-form video content platform, has opened up a new avenue for advertisers to connect with audiences in bite-sized, engaging formats.

Since the past few years, TikTok has emerged as a formidable force in video advertising. The platform’s short-form video content, combined with its algorithm that personalizes user feeds, offers advertisers a potent mix of engagement and reach. The platform’s e-commerce integration also allows for shoppable video ads, blurring the lines between content and commerce.

As iPhones and Androids become even more integral to our daily lives, advertisers are capitalizing on this shift, leveraging the potential of mobile screens to connect with audiences in more personalized and engaging ways.

Mobile video advertising spending has witnessed a meteoric rise, reflecting the growing importance of mobile as the primary screen for many consumers. Several factors contribute to this surge:

As spending skyrockets, understanding which mobile ad units generate the highest ROI becomes paramount for advertisers. Here are the standout units in 2024:

With a vast majority of mobile time spent within apps, in-app video ads are a goldmine. These ads, especially those integrated seamlessly within the user experience (like rewarded video ads in mobile games), see higher engagement rates and better conversion.

Designed specifically for mobile screens, vertical videos take up the entire screen, providing a more immersive experience. Platforms like Instagram and Snapchat have championed this format, and it’s a staple in mobile video advertising right now.

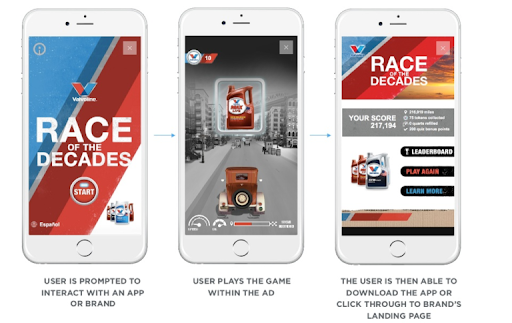

Going beyond passive viewing, playable ads offer a short interactive snippet of a game or app, enticing users to download the full version. Their interactive nature ensures higher engagement and recall.

Merging video content with interactive elements, these ads can feature polls, quizzes, or even mini-games. They not only engage users but also provide advertisers with valuable feedback and data.

According to the IAB (Interactive Advertising Bureau), digital video ads fall into two categories, linear and nonlinear. Linear video ads are advertisements that feature during a video either before, in the middle or after the video.

Nonlinear on the other end typically consists of ads that overlay video content and means that streaming or video content does not have to stop for these ads to display like with linear. Let’s dive a little deeper into the different types of video ads within each of these categories and their ad units.

In-stream video ad formats include pre-roll (before the video plays), mid-roll (in the middle of the video) and post-roll (after the video has finished playing).

Most of the time these ads cannot be stopped by users and are displayed within a long or short video. If you have ever watched a video on YouTube, you would have noticed pre-roll video ads used on videos where content creators have enabled monetization. These ad units can, however, get blocked by ad blockers most of the time.

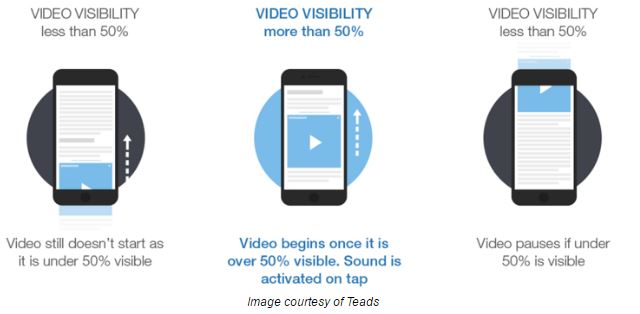

OutStream video ads occur in a much more non-traditional sense outside of video content. Out-stream ad units make use of existing ad units and ad locations within a page to deliver video ads. The focus here is on a non-video based environment which may include but not be limited to text content, social feeds and more.

It’s a much newer form of video ads and not as widely in use as in-stream. An example can be a user visiting a text-based web page, and as they scroll down, a video opens up and starts playing with its audio muted.

As with in-stream video advertising, different types of out-stream ad units also exist. These ad units include:

In-banner: Think of a traditional display ad unit, but instead of rich media, a video is shown in its place.

In-article: Just as the name says, these ad units display the video within the content as the user scrolls, and the ad unit comes into view.

Native: These ad units help video ad publishers run ads within the prescribed IAB native ad sizes through widgets and various other listings. They can also contain headlines and descriptions.

Interstitial: These video ad units are used to transition users from one page to another and get placed between the end and beginning of web pages.

Source: Mobilemarketingmagazine.com

Out-stream video advertising breaks boundaries previously in place by in-stream, seeing as video content does not bind these ads. It makes it easier for advertisers to find highly targeted audiences and for publishers to grab hold of ever-increasing video ad budgets.

Instead of having to produce video content to get a piece of the video ad spend, publishers can implement video ad monetization for traditional web-based content with video.

Advertisers also seem to have more control and guarantee from this ad unit type. Not only do out-stream video ads pause when a user scrolls further down or up the page, but research has also indicated that user retention increases with this format.

Out-stream ads get viewed 25% more than in-stream. Keep in mind that it’s not without its shortfalls. Out-stream video ads can be very intrusive. Publishers and advertisers need to think carefully about their strategy when adding these ads to their ad stack or serving them to an audience.

Interactive Video Ads: Allowing users to interact directly with the ad, these units offer options like polls, quizzes, or clickable elements leading to product pages.

Shoppable Video Ads: Prominent especially on platforms like TikTok and Instagram, these ads allow users to make direct purchases from the video, streamlining the buyer’s journey.

AR-enhanced Ads: Platforms like Snapchat and Facebook have delved deeper into augmented reality, offering ads that integrate with the user’s environment for a more immersive experience.

Story and Short-form Video Ads: With the popularity of Snapchat Stories, Instagram Stories, YouTube Shorts, and TikTok videos, short-form video ads have become a staple. They offer quick, impactful messaging to capture the ever-decreasing attention span of online audiences.

VR-driven Ads: Though in their nascent stage, virtual reality ads are starting to gain traction, especially in gaming platforms and apps dedicated to VR content.

As with display advertising, many video ad networks exist that publishers can utilize in their ad stack for additional revenue. Be sure to check out MonetizeMore’s updated list of the top video ad networks for 2024 here.

However, as with any ad network or type of monetization that you add to your website, be sure to test it before coming to any definitive conclusion. Results may vary between publishers.

If you’d like to find out which ad networks would best fit your site or how to increase your ad revenues, book your free consultation today!

When monetizing content with video ads, it is essential to understand pricing definitions so that you can accurately compare monetization sources and determine the profitability of your ads. Keep in mind that these definitions were sourced from the IAB, but it is recommended to double check definitions of pricing models with each ad network you use.

Different companies may have non-standard viewpoints of viewability. Here are the most critical video ad pricing definitions you need to understand before monetizing with video ads.

| CPM | Cost per thousand impressions is a metric well known by most publishers and does not need any further explanation.

CPM = Total cost/total impressions x 1000 |

| CPCV | Cost per complete view typically refers to an action where publishers are only paid if a video is watched until 100% completion.

CPCV = Total cost/completed views |

| CPV | Cost per view means that the advertiser pays whenever the video ad starts playing. No guaranteed video watch time is included, unlike CPCV.

CPV = Total cost/total views |

| VCPM | Viewable cost per thousand is a metric which focuses on viewable impressions (where videos are viewed by the user for more than 2 seconds) in 1000 units.

VCPM = Total cost/viewable impressions x 1000 |

| VCPV | Viewable cost per view is a combination of previously mentioned pricing models usually referring to a completed view.

VCPV = VCPM/CPV |

| CPE/CPI | Cost per engagement or interaction is where advertisers only get charged when the user interacts with the video. |

| Time-based pricing | This can refer to CPS (cost per second) or CPH (cost per hour). Here the advertisers pay only for agreed upon viewable time impressions with a minimum view time per 1000 impressions. |

Header bidding continues to drive vast profits for many publishers. It should come as no surprise that header bidding within other advertising types such as video and mobile would also become the norm.

If you don’t know what header bidding is, be sure to read our article on it here and also check out MonetizeMore’s proprietary technology called PubGuru Header Bidding. Video header bidding has many similarities compared to traditional header bidding which originates mostly from display advertising.

Publishers can gain access to multiple demand sources and eliminate the old waterfall ad inventory set up to generate the maximum yield. This process usually takes place in the header code of a website, but video players on the other end don’t contain header tags.

However, the process of video header bidding can still be implemented with some clever coding within a page’s header tags while working together with the video player.

As with almost anything within AdTech, there are some pros and cons. For publishers, a definite benefit to implementing video header bidding is increased yields/higher CPMs.

Some reports have even stated that header bidding can increase CPMs over 50%. With video CPMs already being higher than display advertising, it makes it all the more lucrative. On the other end, latency and slow loading times seem to hinder the video header bidding process.

AdSense for video is another way for publishers to get a piece of the ever-growing video market. This Google channel allows you to monetize your video content via desktop or mobile devices. Be sure to adhere to the AFV policies for content requirements, video player implementation, and ad-serving guidelines.

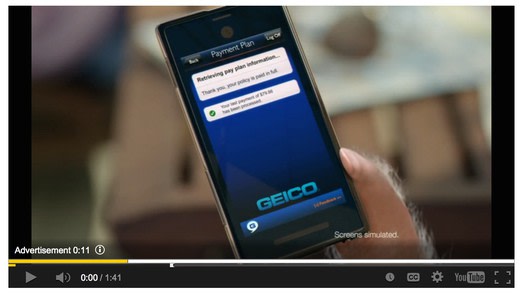

Through the AdSense for video network, you can gain access to a range of video ad units similar to what has been previously mentioned from the IAB earlier in this article. This includes linear formats such as pre-roll, mid-roll, post-roll with skippable and non-skippable options and also non-linear overlay ads. Take a look at the linear format ad example below.

For integration options, you can either choose direct integration and work with Google’s SDK or work with third-party platforms who have partnered with Google. Be sure to visit their technical quick start guide to see all the third-party video players and installation guides and also take a look at this guide.

Programmatic video advertising refers to the use of machine learning algorithms to purchase video ad space in real-time, without the traditional method of manual buying. It leverages data insights and uses automation to ensure that video ads reach the right audience at the right time, optimizing for maximum engagement and ROI.

Programmatic video advertising within apps uses automated technology to purchase and place video ads in real-time within mobile app environments. This method leverages data analytics to ensure that the video ads are displayed to the most relevant audience segments, maximizing engagement and conversion opportunities.

Be sure to read more about programmatic advertising here if this concept is new to you.

As AdTech constantly evolves, so do the methods and mediums through which brands reach their audiences. The realm of video advertising is no exception. Looking ahead to 2024 and beyond, several key trends are set to redefine the industry. From the rise of OTT and CTV to growing concerns about ad fraud, let’s explore the future of video advertising.

Over-the-top (OTT) and Connected TV (CTV) have transformed from emerging trends to dominant forces in video advertising.

OTT platforms deliver film and TV content via the internet, bypassing traditional broadcast and cable television platforms. As cord-cutting becomes more prevalent and viewers flock to platforms like Netflix, Hulu, and Amazon Prime Video:

CTV refers to televisions that connect to the internet. As smart TVs become more affordable and widespread:

As video advertising on digital platforms grows, so does the potential for ad fraud. By 2024, forecasts suggest a worrying trend:

Video content is consuming the internet and remains one of the most effective content mediums for not only grabbing a user’s attention but also holding it.

To put together a comprehensive Video Monetization strategy, you need to build your ad technology stack to include Ad Servers, Video Players, and Ad Units. Alongside an expert ad ops team fine-tuning your auctions as well as introducing new advertising partners.

Want to know how to 10X your video advertising ad revenue? Sign up for a Premium account at MonetizeMore today!

With over ten years at the forefront of programmatic advertising, Aleesha Jacob is a renowned Ad-Tech expert, blending innovative strategies with cutting-edge technology. Her insights have reshaped programmatic advertising, leading to groundbreaking campaigns and 10X ROI increases for publishers and global brands. She believes in setting new standards in dynamic ad targeting and optimization.

10X your ad revenue with our award-winning solutions.