This post was most recently updated on September 26th, 2023

As many industry professionals are already aware, Google has taken the strategic decision to delay its bidding deadline, a move that’s sparking debates and discussions across the digital landscape.

This move reflects Google’s commitment to ensuring a smooth and seamless integration for publishers. Such a step not only paves the way for enhanced optimization but also underscores the tech giant’s dedication to adapting and catering to the needs of its vast user base.

Within this article, we will delve deep into the ramifications of this change, offering insights and analyses to shed light on the evolving dynamics of the digital advertisement sphere.

To comprehend the weight of this announcement, it’s imperative to have a foundational understanding of Google’s bidding process.

Bidding in the Google Ecosystem: This is a complex algorithm-driven process where advertisers bid for specific keywords or audiences. The goal is to position their advertisements in the most visible sections of Google’s platforms, be it on the search results page, YouTube, or Google Display Network.

For publishers, this essentially means adapting their strategies to incorporate Google’s bidding ad units, especially if they wish to remain relevant and effective in their advertising endeavors.

Google, in May, unveiled a game-changing decision in its advertising approach. Here’s a simplified breakdown of what this means for publishers:

1. The Big Change

Google will no longer support the traditional method of delivering ads, known as non-bidding calls, starting from 31st October 2023.

2. Google’s Historical Stance

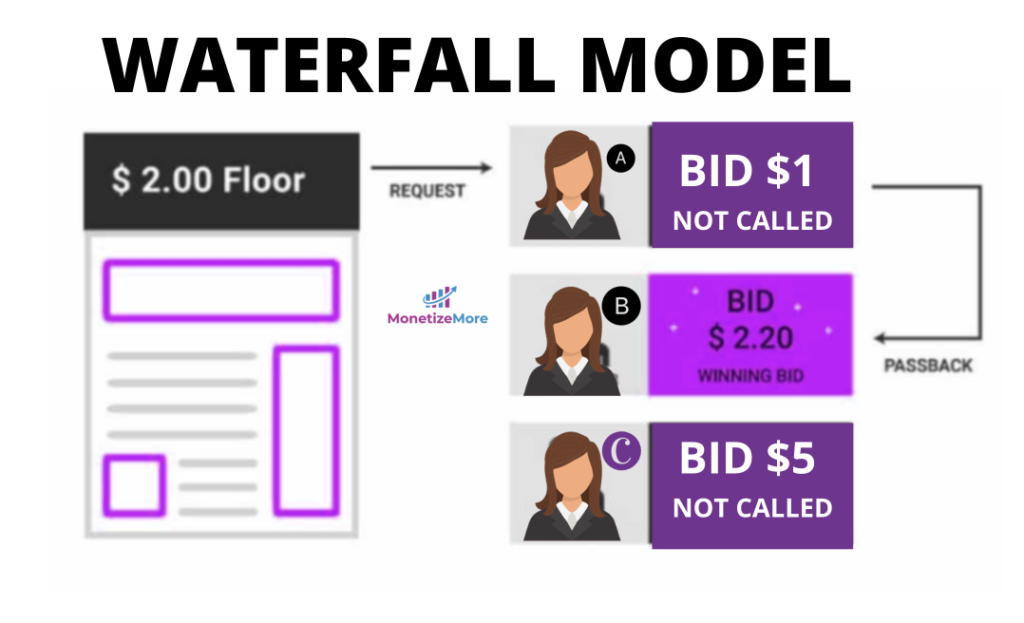

Traditionally, Google has kept its advertising demand largely exclusive to its own platform, AdMob. They did this by not openly promoting bidding outside AdMob, instead preferring a fixed pricing model, known as “waterfall instances.”

3. A Sudden Strategy Shift

Now, Google is urging publishers to move away from these waterfall instances. Instead, they want publishers to adopt AdMob’s bidding system.

4. Who Does This Impact?

This change affects a broad spectrum of publishers, especially those using ads to generate revenue for their games and apps. Given AdMob’s ubiquity in the ad space, this is a significant chunk of the publishing world.

5. The Core Takeaway

For publishers, the traditional method of earning through fixed ad prices on AdMob is coming to an end. In its place, a more dynamic system of real-time bidding will become the norm. This shift will require publishers to adapt their monetization strategies, ensuring they are aligned with Google’s new direction.

In essence, Google is steering the ad industry towards a more competitive and real-time approach, which could lead to better ad placements and potentially higher revenues for publishers willing to adapt.

There are several implications and potential reasons for Google’s decision to delay its bidding deadline:

It’s possible that Google is recalibrating its strategies to better align with market demands. By delaying the bidding deadline, it grants advertisers additional time to refine their ad campaigns, ensuring optimal targeting and reach.

The digital advertising ecosystem is in constant flux. Google might be rolling out new features or algorithms, and this postponement could be a buffer to ensure a smooth transition and integration.

The ad world is competitive. With the rise of various platforms and changing user behaviors, it’s essential for Google to maintain its dominant position. This delay could be a step towards reevaluating the competitive landscape and repositioning its offerings.

Google’s transition from waterfall instances to exclusively bidding through AdMob had significant ramifications for the digital publishing community. Here’s a clear, SEO-centric breakdown of this monumental shift’s immediate and potential outcomes.

In sum, Google’s pivot towards a bidding-exclusive approach serves both challenges and avenues for adaptation for publishers. Navigating this evolving terrain will be vital for sustaining optimal ad revenues and performance.

Earlier, mobile publishers integrated GAM partner line items into their waterfalls, enhancing the competitiveness of their ad strategies. The core of the demand from these GAM partners stemmed not just from their direct or resale ventures but crucially from Google itself. This tactic enabled publishers to amplify their access to Google’s demand, boosting their eCPM and overall ad ARPDAU.

However, Google’s transition to an exclusive bidding system signaled an end to this strategy. The outcome? Publishers face potential declines in eCPM, while GAM partners confront a pivotal decision: diversify their demand sources, diminish their reliance on Google, or contemplate a total business overhaul.

Yes, session RPMs (Revenue Per Mille) will likely be impacted as well. Given that Google’s transition affects eCPM and overall ad ARPDAU for publishers, there will be a direct ripple effect on session RPMs. When the core components like eCPM face potential shifts, it translates into changes in how much revenue is generated for every 1,000 sessions. Thus, any alteration in the demand structure, bidding process, or ad strategies can influence session RPMs for publishers.

The decision to implement major changes around Q4 of 2023 can be rooted in various strategic and operational reasons:

Google’s decision to postpone its bidding deadline is not just a shift in dates. It’s a move that signals potential changes in the digital advertising ecosystem. From strategic recalibrations, and technological upgrades, to shifts in market dynamics, this delay is more than meets the eye. As stakeholders in this space, staying informed and agile is the key to navigating these evolving tides.

With over ten years at the forefront of programmatic advertising, Aleesha Jacob is a renowned Ad-Tech expert, blending innovative strategies with cutting-edge technology. Her insights have reshaped programmatic advertising, leading to groundbreaking campaigns and 10X ROI increases for publishers and global brands. She believes in setting new standards in dynamic ad targeting and optimization.

10X your ad revenue with our award-winning solutions.