This post was most recently updated on March 11th, 2025

Step into the Future of AdTech: Unveiling 2025 Predictions for Publishers! As we embark on a new year, the programmatic advertising landscape is set to undergo a seismic shift, presenting both challenges and opportunities for publishers. With the anticipated delay in cookie deprecation, the rise of AI-driven solutions, and evolving trends in global ad spend, it’s important for publishers to stay informed and agile.

Discover how to leverage these insights to enhance your strategies, maximize revenue, and maintain a competitive edge in an ever-evolving market. Don’t miss out on the essential knowledge that will empower your publishing journey this year!

Related read: https://www.monetizemore.com/blog/programmatic-advertising-explained/

In 2025, programmatic advertising is set for a significant wave of consolidation driven by economic pressures and the need for operational efficiency. This trend will likely simplify processes for publishers but may also limit their options, potentially leading to higher costs. To navigate this evolving environment, actively seek strategic partnerships that provide stability with the best innovative tools. Other than that, diversifying demand sources is a must to mitigate risks associated with a shrinking pool of providers.

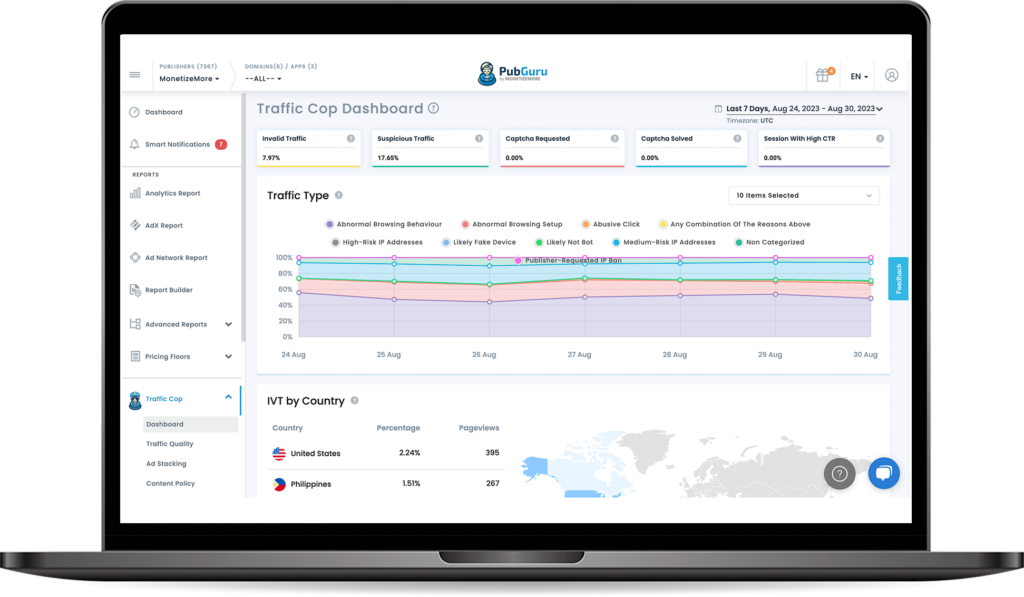

As we move into 2025, I’m worried about the continued rise of bot traffic and other forms of invalid traffic (IVT). This concern has been building up since the last few years. In 2024, we saw a marked increase in the sophistication of bot activities, which made them harder to detect. This trend, combined with fraudulent activities like ad stacking and pixel stuffing, led to a significant rise in IVT. As a result, advertisers have been increasingly worried about the diminishing returns on their investments, with a large portion of their budgets being wasted on non-human traffic.

From my perspective, this surge in IVT poses a real threat to publishers’ reputations and their financial viability. The perception that their digital spaces are compromised by invalid traffic could lead to a loss of trust from advertisers, potentially resulting in a decrease in ad revenue. Similarly, as someone closely monitoring the trends, I see Supply-Side Platforms (SSPs) and Demand-Side Platforms (DSPs) facing their own set of challenges. They need to enhance their technology to better identify and filter out this sophisticated IVT, a task that is both costly and demands ongoing innovation.

In response to these challenges, I foresee a significant focus in 2025 on developing and implementing advanced IVT detection tools. Award-winning tools like Traffic Cop which harness AI and machine learning, will be key in effectively identifying and combating bot traffic. I also anticipate a move towards greater collaboration within the industry. Sharing data and insights to fight IVT collectively could lead to the establishment of industry-wide standards and a boost in transparency.

In 2025, the integration of AI will revolutionize how publishers approach ad targeting, brand safety, and monetization strategies. By moving away from outdated keyword-based methods, AI empowers publishers to leverage precise targeting solutions that unlock deeper content insights, enhancing contextual relevance and streamlining workflows. This transformation not only boosts revenue per mille (RPMs) but also enables the development of robust brand safety measures and stronger advertiser relationships. As AI reshapes revenue strategies, publishers can showcase the unique value of their premium content, gaining a competitive edge in a crowded market.

Thanks to the spotlight on made-for-advertising (MFA) sites, AdTech will be getting a big makeover. These sites, hogging a big chunk of online impressions, are not just guzzling down global ad spend but also upping the carbon waste and muddling supply-chain optimization.

The good news though: in-app and CTV are totally MFA-proof, offering a savvy shift in where the budget’s going. We’re seeing a cool move from exchange spends to more deal spends, like PMPs. Media buyers are getting smart, leaning into platforms offering first-party audience synergies and data that go beyond just behavior tracking.

In 2025, the competition between Supply-Side Platforms (SSPs) and Demand-Side Platforms (DSPs) is expected to intensify significantly as both seek to capture a larger share of ad spending and deliver enhanced value to their clients. This heightened competition will drive SSPs to prioritize transparency, robust performance metrics, and access to high-quality demand sources. For publishers, aligning with the right SSPs will be crucial for optimizing revenue streams and identifying new growth opportunities in an increasingly competitive market.

Conduct thorough audits of their existing partnerships, focusing on transparency and performance outcomes. Diversifying demand by collaborating with multiple SSPs will not only mitigate risks but also enhance revenue potential. Actively seeking out SSPs with unique offerings can further enrich the publisher’s portfolio, creating a more attractive business model that draws in a wider array of advertisers and ultimately increases session RPMs.

The upcoming AdTech era will be characterized by enhanced collaboration between buyers and sellers, focusing on the transparent and ethical exchange of data. This shift marks a significant change in how the industry values and handles consumer privacy and data transparency.

While the ad revenues might dip in the short term, publishers will be able to compensate for these dips via more optimal ad tech implementations and optimizations like server-to-server, video header bidding, and bot blocking. Opportunities to increase RPMs and ad revenues have never been greater for publishers, but a proportional demand for resources would be necessary. As the industry matures, complementary tools and services will be available to make these types of implementations more accessible.

2025 will look even better for you with 10X more ad revenue. Click here to achieve that now.

With over ten years at the forefront of programmatic advertising, Aleesha Jacob is a renowned Ad-Tech expert, blending innovative strategies with cutting-edge technology. Her insights have reshaped programmatic advertising, leading to groundbreaking campaigns and 10X ROI increases for publishers and global brands. She believes in setting new standards in dynamic ad targeting and optimization.

10X your ad revenue with our award-winning solutions.