This post was most recently updated on September 14th, 2021

Recently Google announced they will be moving from a second-price to a unified first-price auction in Google Ad Manager. They will also be removing last look, a function that has given them an advantage at winning bids for clients that advertise through Google. The change is set to take place at the end of 2019.

To help you navigate this critical development in Google Ad Manager, we’ve decided to create a guide explaining all the details. Let’s dive right in!

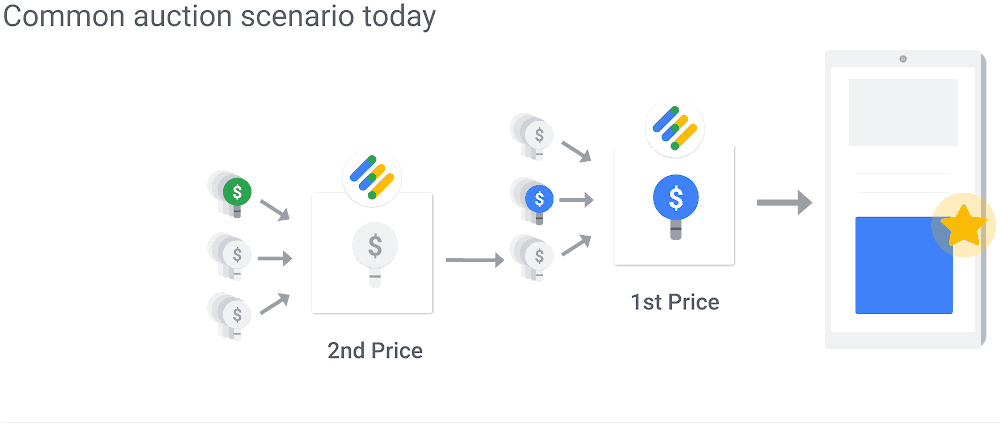

In this modern programmatic day and age, an ad goes through multiple auctions before a winning bid gets selected. With the current second-price auction set up in Google Ad Manager, Google runs two auction processes.

The image below gives a quick overview of a usual second-price auction.

Second price auctions mean the winner pays not their bid, but just over the rate of the second bidder. Let’s look at some examples of how the legacy model works with a hybrid of first and second price auctions.

Example 1. You have the following line items:

The $5 header bidding line item and the bidder pays $5.

Example 2. You have the following line items:

The $5 header bidding line item and the bidder pays $5.

Example 3. You have the following line items:

The Google AdExchange bidder wins the line item, but because they’re bidding at second price, they pay $5.01 for the impression.

Example 4. You have the following line items:

The Google AdExchange bidder wins the line item and is second priced by the floor, paying $7.01.

Example 5. You have the following line items:

The $10 Google AdExchange bidder wins the impression and pays $7.01.

Example 6. Your impression received the following bids (not to be confused with line items):

In this example, the $3 header bidder wins the auction and pays $3. This is because the $3 bid from the Google AdExchange bidder goes into the auction at $2.51

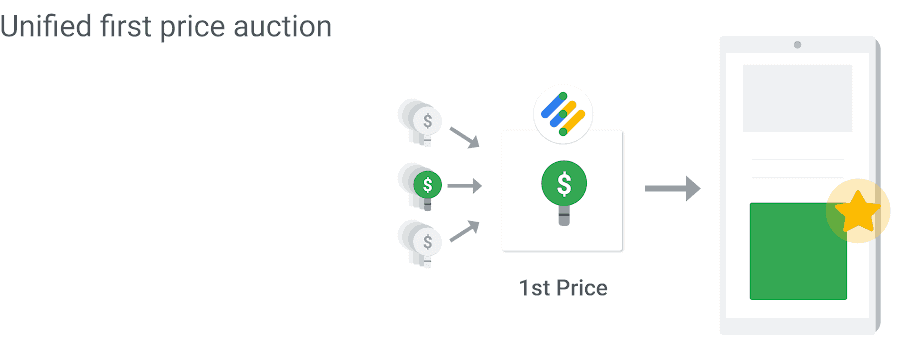

With unified first-price auctions, instead of having a single price auction followed by a second price auction, there is a single auction, and the top bidder pays their bid price. In the first two examples above, the $5 header bidder is the highest, so they win and pays $5. In the remaining examples, the $10 Google AdExchange bidder wins and pays $10.

The image below puts the first-price auction into better perspective.

There are benefits of first-price auctions to both publishers and advertisers. Here are some of them:

Last look is that second price auction that fires after the first price auction. While switching over to first-price auctions, Google will also remove it’s “last look” function. Last look gave advertisers and those connected to Google a competitive advantage. After an auction was completed, Google was able to allow advertisers through AdWords and their DSP to pay only one cent more to win an ad impression.

To their benefit, they could win auctions for ad inventory and at great prices for advertisers. Through this feature, publishers had limited control with regards to prioritizing their ad stack. Now with its removal, publishers need less complex price floor strategies to optimize ad revenue.

One of the key parts of understanding this change is what parts of the auction it impacts. The first key part of a first price auction is it increases transparency around hidden intermediary fees by eliminating the uncertainty in what the paid rate was. We’ll talk about this later as it has some significant impact on the bid landscape.

One notable part of last look and second price auctions is that switching to a first price auction increases bidder certainty in what they will pay for impressions, but it decreases transparency as to what others are willing to pay.

When a bidder historically offers $10 and consistently averages a $7 closing price in a second price auction, they know unequivocally that for that impression either another bidder offered that rate, or they were floored at that rate.

Keep in mind that Google will still run second-price auctions in products such as AdSense, YouTube, and a few others. This primarily impacts Google AdExchange, Google Exchange Bidding, header bidding, direct-sold inventory, and managed demand.

The first and most likely impact is that Google has very likely done statistical research to internally prove that this will improve monetization outcomes for Google and advertisers using Google’s platform.

Note that this is different from the idea that Google will take more share-of-voice with AdExchange – simply that after Google’s revenue shares for GAM and DV360 (formerly DBM), Google will very likely make more. Any assumption that Google AdExchange will increase share-of-voice is unsupported because the auction econometrics is a dynamic system and bidders have very reactive strategies.

It is still safe to say though that Google, like all public companies, tends to act in the best interest of their shareholders. It’s not just Google’s modeling; most vendors still running second price auctions switched over to first price auctions in 2017.

The second and most likely impact is that bidders will change their bidding behaviors. This is why most predictions around the impact of this change are very low certainty. For example, if a particular advertiser wanted a specific segment, they might have historically found that they can bid $10 and average out to paying $7 for that segment.

When the auction becomes a unified first price auction, their $10 bids will no longer close at $7; instead, they’ll pay their bid price ($10). Another example is how when MonetizeMore rolled out our dynamic AdX flooring technology, header bidders responded by bidding higher to remain competitive increasing, not just AdX revenue, but also header bidding revenue.

This reactive behavior will create a few archetypes of bidders and their immediate strategies:

Complicating matters even more; each of these strategies affects each other significantly. Bidders in the first group will have choked off their demand, allowing bidders in the second group to lower their bid substantially more than their historical second price closing rate.

Bidders in the third group though will effectively be blowing auctions away, sniping impressions at a rate significantly higher than the market value of the impression. The bidders from the third group will also burn budget substantially faster in the beginning, leaving them less ad spend in later parts of their campaigns, which in turn will push them to join the first group of conservative bidders as they figure out what went wrong.

The outcome of whether Google AdExchange increases share-of-voice entirely depends on the breakdown of where bidders stand and how fast Google can get its bidders to adjust strategies.

Further forecasts of what will happen to tend to remain in the realm of speculation and low certainty.

Possibly, but not necessarily. After the dust settles from bidders altering their strategies in the months after the change, the key comes down to disintermediation and pathing from the originating advertiser through numerous ad tech vendors until the bid makes its way to the publisher.

For example, the advertiser pays their agency who then pays the DSP who then pays an aggregated chain of SSPs, who ultimately provide multiple net bids to the publisher. The publisher takes the bid that nets them the most. The bulk of buyer demand is not unique. Most advertisers are on multiple DSPs, so they have multiple pathing options in obtaining the same impression.

If they go one route, that DSP might take 20%, an intermediary SSP takes 30%, and an end SSP takes 20%, a $100 gross bid will yield a $44.80 net bid. Now on another route to the same impression, a different DSP might take 30%, a different SSP takes 30% with no intermediaries, and ultimately a $100 gross bid will yield a $49.00 net bid.

Even though the bidder provided the same gross bid to both paths, they have two different bids going into the publisher’s auction, and their $49 bid will beat their own $44.80 bid. Now consider that these examples are just 2 or 3 hops from advertiser to publisher.

The ad ecosystem often sees significantly more hops than that, with each vendor taking a cut. Assumptions that claim reduced value discount the likelihood that header bidders will change their behavior too.

Another compounding factor is bidders who use a variable revenue share. As an example, AppNexus, Rubicon, and Google all use fixed revenue shares, but OpenX is one of the higher tier bidders with a variable revenue share. All of their bids come to the publisher as net bids, but the revenue share that OpenX takes can vary greatly.

Sometimes this is because of the arrangement they have with their DSPs. Other times, this is because internally their bidding strategy intentionally lowers their cut and pass more onto the publisher to increase the probability of winning the impression.

If they didn’t lower their cut, they’d lose the impression and not get paid at all. This compounds the uncertainty in what will happen because not only will bidders change their strategies, SSPs with variable revenue shares can adapt their approach too.

And finally, another impact of removing last look is that Google AdExchange buyers (including AdWords) will no longer be able to snipe impressions with the certainty that they will pay only a penny more than the next highest bidder. This advantage will disappear.

Bidders who do not immediately adjust their bid strategies will burn budget significantly faster, which reduces their ability to bid on additional impressions. Remember, major advertisers typically contract with ad agencies who ultimately plan out fixed budgets and spend across DSPs.

If the budget in a period is exhausted, that’s it. If the budget in a period is not yet exhausted and the impression goal has already been reached, most ad contracts incentivize agencies to reallocate the remainder as incremental ad spend and acquire more impressions.

Because so much of the impact of this change is dependent on how bidders react, it’s important to focus on what publishers have control over.

Review your revenue shares. Ultimately, this change is about transparency and will make it easier for bidders to find the pathing from advertiser to a publisher that nets them the most impression value. As above, the high certainty outcome isn’t that Google AdExchange will get more share-of-voice; it’s that Google will improve its yield.

Header bidding will still offer significant value, even for non-unique demand, but the increased transparency around bid pathing makes negotiated revenue shares more critical than ever. For example, any bidders at or above 30% revenue share will see significant downward pressure, and this will happen whether they like it or not.

Revenue shares follow a Laffer Curve – if the cut is too high, the net bid goes into the auction too low, it cannot win, the bidder doesn’t win the impression, and they make nothing. If the cut is too low, they’re leaving money on the table.

In these respects, it can be hugely beneficial to work with a managed ad optimization company like MonetizeMore, as we have insight across numerous publishers as to what revenue shares each bidder will accept in which circumstances.

Change your bid flooring strategies. Even before the days of header bidding and fully programmatic ad stacks, publishers found bid floors to be very helpful in yield optimization. The entire programmatic industry exists because publishers set rate card which they stood firm on, and then sold the remaining inventory as the remnant.

No one wants to undersell inventory. Switching to a unified first price auction alters the econometrics around bid floors, but does not eliminate the value they provide. Even Google’s guidance advises that publishers will need to “rethink how they use price floors.”

Focus on demand sources with significant unique demand. We’ve written extensively on this matter, and a fundamental auction change like this will only make this even more important. Partners with little unique demand will also see significant downward pressure on their share-of-voice as they continue to get disintermediated.

Ad tech can be confusing, especially if you’re not an expert at it. As a publisher, you might not want to get your hands dirty with all the nitty gritty yield optimization and ad-related work and instead focus on the part of your business you’re great at.

Why not have the ad tech experts help? Let us help you navigate the switch from second to first-price auctions and help you come out on top by maximizing your ad revenue.

10X your ad revenue with our award-winning solutions.